Business Insurance in and around Omaha

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Cost Effective Insurance For Your Business.

When you're a business owner, there's so much to keep track of. It's understandable. State Farm agent Cort Bonner is a business owner, too. Let Cort Bonner help you make sure that your business is properly covered. You won't regret it!

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Surprisingly Great Insurance

Did you know that State Farm has been helping small businesses grow since 1935? Business owners like you have relied upon State Farm for coverage from countless industries. It doesn't matter if you are a sporting goods store or a taxidermist or you own an auto parts shop or an advertising agency. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Cort Bonner. Cort Bonner is the person who relates to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to understand your small business insurance options

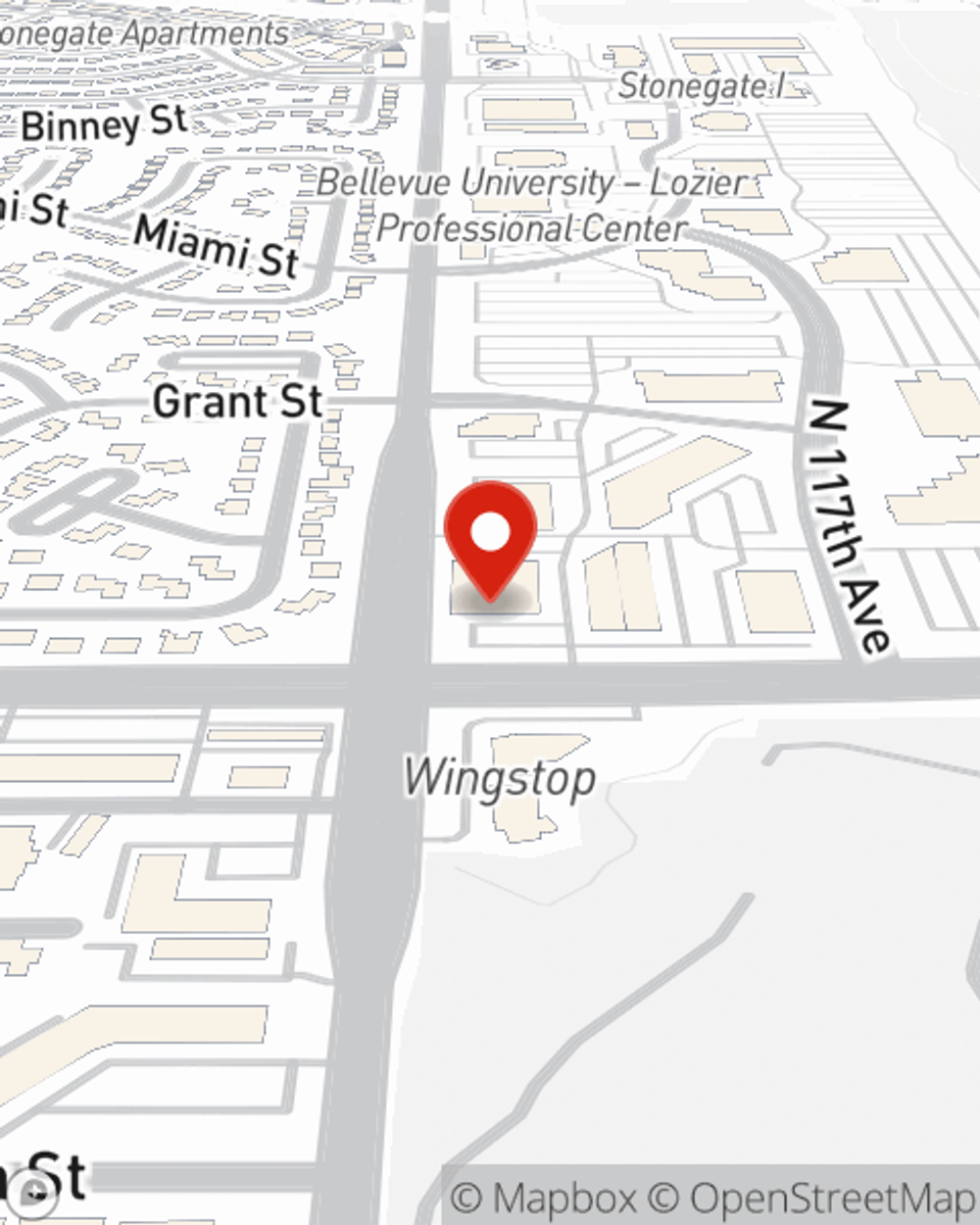

At State Farm agent Cort Bonner's office, it's our business to help insure yours. Reach out to our wonderful team to get started today!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Cort Bonner

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.